Live Interpretation Manager of Historic Royal Palaces and King Arthur Expert Christopher Gidlow is the Live Interpretation Manager of Historic Royal Palaces. He specialises in bringing history to life at the Tower of London, Hampton Court Palace, Kensington Palace and the Banqueting House Whitehall. He is also responsible for interpretation on the project to open the Georgian Kitchens of Kew Palace to the public. He is also a director of the International Museum Theatre Alliance (Europe). A life-long enthusiast for the Arthurian legends, Christopher describes being told by his primary teacher that they might have a basis in fact as…

-

-

Egyptologist 11 November 1942 Dr Rolf Krauss is a renowned German Egyptologist who – prior to retiring in 2007 – last worked as a researcher at the Berlin Museum of Prehistory and Early History, and as a lecturer at Humboldt University. He has produced a number of important studies into ancient Egyptian chronology and astronomy. Born in Heidelberg in 1942, Dr Krauss studied at the University of Heidelberg and the Free University of Berlin from 1975 to 1981, gaining his PhD in Egyptology from the latter institution. He went on to work at the Egyptian Museum in the National Museums…

-

Geoff Holder Author and forteana expert Geoff Holder is the author of more than a dozen books on everything mysterious, paranormal, strange, gothic and grotesque. His books are an authoritative mix of extensive historical study combined with diligent field research. They are often geographically-based, with titles such as The Guide to Mysterious Glasgow and The Guide to the Mysterious Lake District. Holder is primarily interested in ‘forteana’ – the world of the odd, the curious, the wondrous, the allegedly paranormal – and its fractious and informing relationship with the so-called mundane world. What do people do when they have too…

-

Exhibitions Currently running Venue Title Area Start End Ara Pacis Museum Lineamenti. Volto e paesaggio Rome 16 Jun 2010 19 Sep 2010 Arkansas Arts Center World of the Pharaohs: Treasures of Ancient Egypt Egypt 25 Sep 2009 5 Jul 2010 Ashmolean Museum, Oxford The Lost World Of Old Europe: The Danube Valley, 5000 – 3500 BC (Ashmolean Museum) World 20 May 2010 15 Aug 2010 Blu Palazzo d’Arte e Cultura Lungo il Nilo/Along the River Nile Egypt 28 Apr 2010 25 Jul 2010 Brooklyn Museum of Art, New York Body Parts: Ancient Egyptian Fragments and Amulets at the Brooklyn Museum of Art Egypt 19 Nov 2009 2 Oct 2011 California Science Center Lost Egypt – Ancient Secrets Modern Sciences Egypt 13 Apr 2010…

-

In modern society, the popularity of online shopping is growing, and gradually it is spreading to all new categories of goods. Nevertheless, in some categories, barriers to online shopping are still high, and in some areas of retail, online trading is currently prohibited by law or possible with restrictions. Pharmaceuticals are included in the list of available for online ordering. However, consumer research and analysis of internal search engine data show that there has recently been an increase in user interest in finding and buying OTC products, vitamins and dietary supplements online. According to surveys, the rate of users who…

-

In the field of microcredit, one significant news is currently being discussed. It lies in the fact that over the past months of 2021, the share of online payday loans has grown significantly – at the moment it has reached its historical maximum. As a percentage, this is 29.6% of the total mass of short-term loans. Such data were provided by the Bureau of Economic Analysis (BEA), which includes 80% of all companies that are engaged in microfinance. Comparing indicators for online loans in 2021 and 2020 In the first quarter of 2021, 2.7 billion dollars of loans were issued.…

-

Yuval Peleg Israeli Antiquities Authority’s head district archaeologist for the Jordan Valley Israeli Antiquities Authority archaeologist Yuval Peleg is the head district archaeologist for the Jordan Valley. His excavations at Qumran, conducted mainly from 1993-2004, have brought him into the middle of the debate raging over the Dead Sea Scrolls. He worked alongside fellow archaeologist Yitzhak Magen. The two of them found that the site was not an Essene settlement and that the scrolls were deposited in nearby caves by refugees fleeing the Roman army, after the fall of Jerusalem, in 70 A.D. Peleg holds an MA in archaeology from the…

-

Three simple steps to start exploring online now. Step 1 Step 2 Step 3 Download and Install the software. Start your preview visit by clicking the button. For a satisfactory experience you will need: a fast internet connection (1.0 mb/s or more). Wireless can work, but is unreliable. a good graphics card with 256 meg RAM (the more the better); 1 gigabyte system RAM; Offices and Schools: No firewall restrictions on external content (see details on fixing here). For Windows For Mac (currently for Intel versions only) Having problems? Check our Frequently Asked Questions (FAQs), and if that doesn’t help,…

-

Paula Veiga Researcher in Egyptology 13 April 1968 Paula Veiga has a background in tourism, but holds a Master in Pre Classical Studies from the University of Lisboa and a Master in Biomedical Egyptology from the Faculty of Life Sciences, University of Manchester (which covers Histology studies and laboratory practice, DNA studies and practice of extraction, Paleopathology, Osteology, amongst other disciplines). She recently published her first book – Oncology and Infectious Diseases in ancient Egypt: The Ebers Papyrus? Treatise on Tumours 857-877 and the cases found in ancient Egyptian human material and has another one upcoming. Paula Veiga is working on…

-

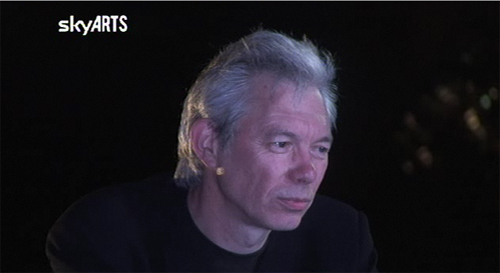

Attribution: Taken from the ‘One & Other’ live video stream. mike pitts Archaeologist and editor of British Archaeology magazine Mike Pitts is an influential freelance archaeologist and writer who edits British Archaeology magazine (since 2003). He has also written trade books such as Fairweather Eden and Hengeworld, and has produced features for BBC History, New Scientist and American Archaeology. A novel and a non-fiction book are also in the pipeline, and Mike has also waded into the world of radio broadcasting with a historical drama for BBC Radio 4. Mike claims his love for archaeology grew from his first observation of…